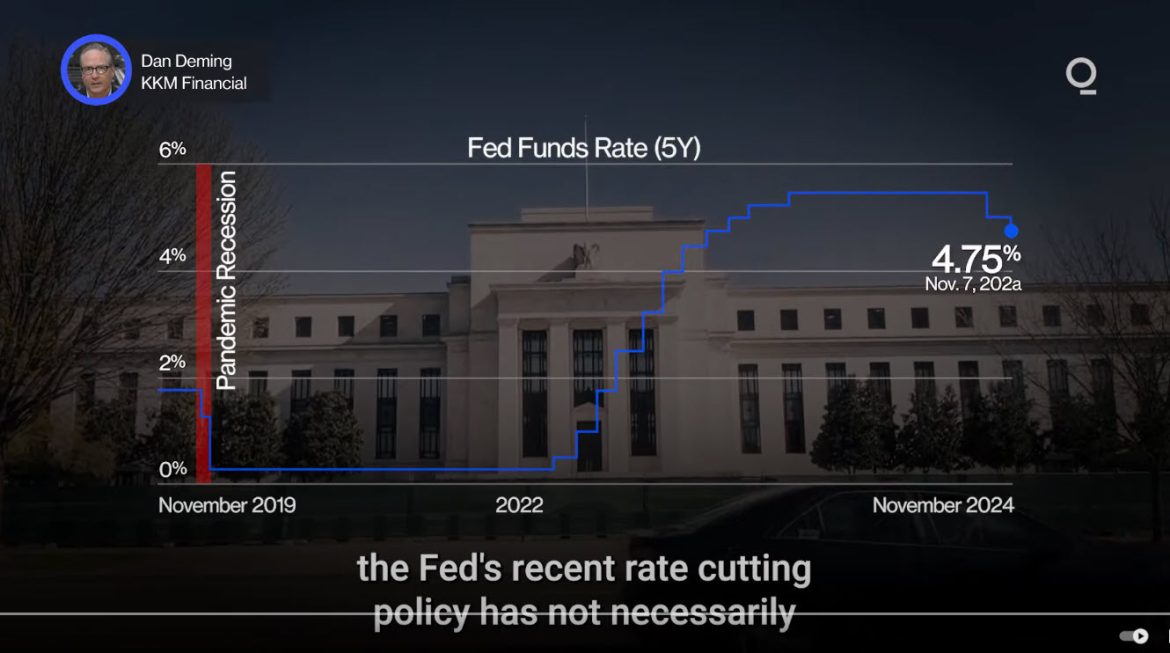

In a surprising turn of events, the Federal Reserve's recent rate cuts have failed to provide relief to millions of American homeowners and prospective buyers. Despite the Fed lowering its official rate to 4.75% from 5.5% in two separate cuts this year, mortgage rates have paradoxically increased, leaving many to question the effectiveness of the central bank's monetary policy.The Fed's decision to cut rates for the first time in four years was widely anticipated as a move to stimulate economic growth and ease borrowing costs. However, the approximately 85 million holders of residential mortgages. . .

Fed Rate Cuts Yet to Reach Mortgage Holders as Lending Rates Climb

369

Subscribe

Login

Please login to comment

0 Comments

Newest